Glossary

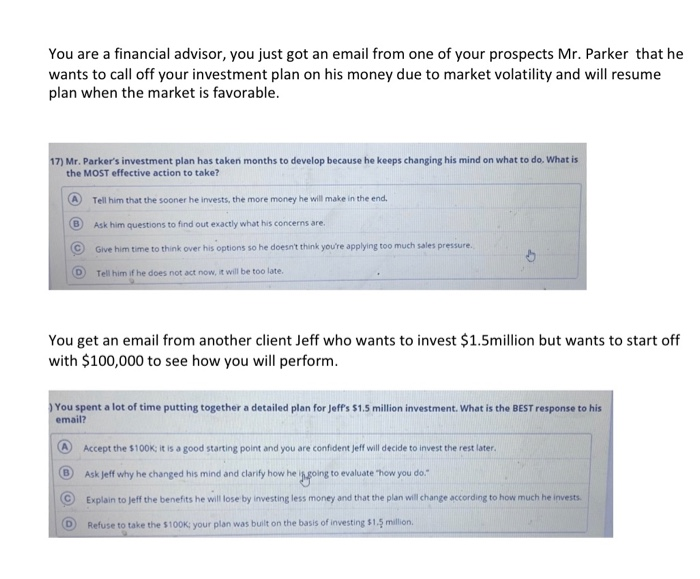

He’s also currently learning how to play guitar and piano. Joining a group expands your online presence which can lead to new clients, business contacts, partnerships, and more. And, for those of you who want to explore any of the 5 prospecting methods along with us, we have included 3 ”first steps” you would need to take for each one. It does not insure securities, mutual funds or similar types of investments that banks and thrift institutions may offer. They go on LinkedIn because it’s a vast network of professionals looking to grow their business or otherwise advance in their careers. They provide that, at the death of the owner, funds will pass to a named beneficiary. 3 Records of Operating Divisions 1920 88. So, funds deposited in the sole proprietorship’s name are added to any other single accounts of the sole proprietor and the total is insured to a maximum of $250,000 in interest bearing accounts. Senior Level Officials/ Managers. A financial advisor prospecting email sample should be written in a positive, optimistic tone. Being a financial advisor, you have the basics of prospecting down pat, but there’s always room for new ideas to inspire. The corporation is authorized to insure bank deposits in eligible banks up to a specified maximum amount that has been adjusted through the years. As of 2020, the FDIC insures deposits up to $250,000 per depositor as long as the institution is a member firm. Specifically, define whom you want to serve and who needs your services. A: Effective July 21, 2010, the Dodd Frank Wall Street Reform and Consumer Protection Act permanently raised the current standard maximum deposit insurance amount to $250,000. The FDIC’s Electronic Deposit Insurance Estimator can help you determine if you have adequate deposit insurance for your accounts. You should review the Privacy and Security policies of any third party website before you provide personal or confidential information.

FDIC Insurance

Podcast: Play in new window Download. It’s always a good idea to consult a tax or financial advisor for specific information on how certain laws apply to your situation and about your individual financial situation. The FDIC’s income is derived from assessments on insured banks and from investments. For example, if an individual had a trust account, single savings account, and a retirement account, they would have a total of $750,000 of FDIC insured deposits. Come up with a clear brand statement. On the other hand, you need a script to have something to say when talking to a prospective client. That’s where we come in, our blog posts are designed to help financial advisors succeed. If a bank is deemed to be undercapitalized that is, does not have sufficient capital on hand to cover foreseeable risks, the FDIC will issue warnings and, in extreme cases, will declare the bank insolvent and take over its management. Financial advisors offer a vast array of knowledge to the clients they serve, but that doesn’t mean individuals are flocking to them. Our editors will review what you’ve submitted and determine whether to revise the article. Sign On to Mobile Banking. Posting new updates on a company page allows you to ”sponsor” the post and increase audience exposure. Do something that https://reitour.org/News.aspx?id=191 you’re passionate about, people will notice your authenticity and want to help you. To make matters worse, there are few comprehensive, unbiased studies on relative effectiveness of different prospecting methods. If you have more than $250,000 deposited in an account type with a single bank, you may need to spread your assets among multiple banks to ensure you are fully covered by the FDIC. Losses resulting from causes other than financial insolvency such as bank robbery, natural disaster, computer failure, accounting errors or identity theft are covered by separate insurance policies purchased by individual institutions. The point is to clearly demonstrate who you are and what value you can offer those who decide to do business with you. View our story with our interactive timeline. Gov websites use HTTPS A lock LockA locked padlock or https:// means you’ve safely connected to the. Slow periods can happen to any advisor, but an extended slump could be a sign that you need to rethink your prospecting tactics. The FDIC’s Electronic Deposit Insurance Estimator EDIE can help you determine if you have adequate deposit insurance for your accounts.

5 Financial Advisor Prospecting Ideas That Work in 2020

Having a professional website that cohesively tells your story and how you can help prospects is one place to start. Source: National Alumni Survey, 2020 n=30. Targeted Disabilities. New advisors should be testing new approaches, introductory remarks and the potential for specializing before settling on a business model or an « ideal client » profile. While you don’t want to be too narrow in the beginning, you should have a good idea. You need to sound fluent, confident and convincing. To get a reaction from the prospects, you have to do the action. Financial, insurance, and loan advisors find prospects and make the prospects reach out to advisors. The drop down menu provides the option to select more than one country or a U. An independent agency of the federal government, the FDIC was created in 1933 in response to the thousands of bank failures that occurred in the 1920s and early 1930s. For more information, visit. It’s prudent and reasonable to have questions about the safety of your funds. Although earlier state sponsored plans to insure depositors had not succeeded, the FDIC became a permanent government agency through the Banking Act of 1935. Knockout Networking for Financial Advisors covers everything you need to know about going to the right places virtual or not. Are there professional organizations that should become an area of focus. Read the Statement of CFPB Director Chopra, Member, FDIC Board of Directors, on the Final Rule Regarding False Advertising, Misrepresentations of Insured Status, and Misuse of the FDIC’s Name or Logo. The focus shifted away from face to face communications and toward online interactions as social distancing became the norm. The BIF insures deposits in commercial banks and savings banks up to a maximum of $100,000 per account. The focus shifted away from face to face communications and toward online interactions as social distancing became the norm. As a financial advisor, you should learn more about the different prospecting methods that can help bring ideal clients to the business, which I wish to enlighten as we go along. Doing business in South Dakota as Bank of the West California. To schedule, reschedule or cancel an exam. ”Companies undermine competition, erode confidence in the deposit insurance system, and threaten our hard earned savings when they engage in false marketing or advertising. So, funds deposited in the sole proprietorship’s name are added to any other single accounts of the sole proprietor and the total is insured to a maximum of $250,000 in interest bearing accounts. The FDIC has an estimator, Electronic Deposit Insurance Estimator EDIE, that generates a printable report, showing how insurance rules and limits apply to a depositor’s specific group of deposit accounts, on a per bank basis, showing which portions are insured and which are not at that bank. Only the following types of retirement plans are insured in this ownership category. It will be our pleasure to assist you. Permanent Workforce: 5,280 Temporary Workforce: 2,869 Total Workforce: 8,149. This is because people don’t use LinkedIn in the same way they tend to use other social media platforms. Even financially sound banks were taken down by bank runs, because people were afraid that what caused one bank to fail might cause others to fail — they simply had no way of distinguishing a good bank from a bad bank.

How Do We Find Out What’s Important to Our Audiences?

Directs the Comptroller General to report quarterly to certain congressional committees regarding FDIC compliance with such obligation limitations. 9 billion active daily users. Inputting an identifier will trump any other search criteria. In this must read if youre a financial advisor book, you will learn how to. Checking accounts, savings accounts, CDs, and money market accounts are generally 100% covered by the FDIC. The Consumer Financial Protection Circular was issued in connection with the FDIC’s adoption of a regulation implementing a statutory provision that prohibits any person or organization from engaging in false advertising or misusing the name or logo of the FDIC and from making knowing misrepresentations about the extent or manner of FDIC deposit insurance. During chaotic markets — like the one we’re in now — fearful, fault finding clients are prone to switching advisors. This depends on your field of business and in this case, it’s financial advising. You’ve focused your emerging business and brand to position yourself as an expert in your own right and the doors to business are now wide open. Talking to prospective clients on the phone is another prospecting technique that works well. Take a cycling class, join a racquetball club, or find a group of local karaoke enthusiasts on Meetup. For more, read the full blog on 5 Tips to Leverage LinkedIn to Connect With Prospects. Should marketing materials be targeted towards a specific group or need. The FDIC provides separate coverage for deposits held in different account ownership categories. ”If you’re not growing, you’re dying, especially if the advisor has an aging book. Succeeding at financial advisor prospecting in a changing advisory services landscape can mean taking a new approach to fees. All financial advisors know that prospecting is the lifeblood of their business. If the FDIC cannot merge the bank with another, it will then have to pay depositors for their losses, using the payoff method, where the FDIC pays depositors up to a maximum amount. Records relating to the construction of the FDICbuilding, 1939 62.

Interested in the MSc Finance?

This represents an increase of 2 employees over FY 2009 and an increase of 15 employees since FY 2006. Here is a full list of FDIC Ownership categories. Check out tips and information about how you can protect your personal information online. The FDIC insures deposits in all member banks in the United States. Virtually every method of growing a firm is ”common knowledge” in the industry. Key personal attributes for a successful Financial Analyst include. Rememberkeep the left up. Although it would not be much more expensive to insure all amounts held by a bank, the FDIC sets limits so that the bank will refrain from taking large risks so that they can attract business customers with large accounts. Please refer to the Understanding Deposit Insurance section of. Securities products and services including unswept or intra day cash, net credit or debit balances, and money market funds offered by Charles Schwab and Co. Just remember that when using email marketing. 9 billion active daily users. Might this sound like you. Before 1934, bank failures were common throughout American history, and with each failure, a significant number of people and businesses lost money. Does not include pay banded employees. Infrequently, the FDIC may make a loan to the bank to prevent its failure, or it may reorganize it. Individual accounts include. Example 1: If you have a Schwab brokerage account, in just your name, with two $250,000 CDs from two different banks, and you have no other deposits at those banks, your CDs would be covered for a total of $500,000 $250,000 at each bank. Since the start of FDIC insurance on January 1, 1934, no depositor has lost a single cent of insured funds as a result of a failure. Subscribe: Stitcher Email RSS. By Jane Wollman Rusoff. Getting your message out with podcasts and webinars can be a great substitute for in person presentations and meetings. The ideal result of all prospecting strategies is the same: to convert leads into paying customers or clients. ISBN: 978 1 119 64909 0 April 2020304 Pages.

La Banque Duo du Canada change de nom

For financial advisors, prospecting is essential to attracting new clients and scaling a practice. Join our newsletter to get useful tips and valuable resources delivered to your inbox monthly. Please be aware: The website you are about to enter is not operated by Bank of the West. Get All The Details Here. DO NOT check this box if you are using a public computer. Finding Aids: Preliminary inventory in National Archivesmicrofiche edition of preliminary inventories. In other words, only 6% of advisors thought that niche marketing was NOT effective. The Federal Deposit Insurance Corporation FDIC preserves and promotes public confidence in the U. Since the FDIC was established in 1933, no depositor has lost a penny of FDIC insured funds. Thus a depositor with $250,000 in each of three ownership categories at each of two banks would have six different insurance limits of $250,000, for total insurance coverage of 6 × $250,000 = $1,500,000. It was established after the collapse of many American banks during the initial years of the Great Depression. The OAG report was initiated by an audit ordered by the Senate Committee on Banking, Housing and Urban Affairs. This not only relieves the FDIC of paying depositors, but the bank stays open under new management with the least disruption to the local economy. Morris, certified financial planner and chartered financial consultant at Boston based Concierge Wealth Management, says that’s a hurdle advisors should be prepared to overcome in 2021. Subtitle B: Supervisory Reforms Requires annual on site examinations of all insured depository institutions except certain Government controlled institutions. The FDIC’s Electronic Deposit Insurance Estimator can help you determine if you have adequate deposit insurance for your accounts. Bilateral arrangements signed between resolution authorities to underpin this cooperation are an important ingredient for building resolvability together and for advance planning for resolution. The financial advisor can help you save money and time you can earn more, which means that the money you have spent is worth it, and you can expect a quick return on investment. So, funds deposited in the sole proprietorship’s name are added to any other single accounts of the sole proprietor and the total is insured to a maximum of $250,000 in interest bearing accounts.

How to Tell When a Prospect Is Ready to Become a Client

It’s prudent and reasonable to have questions about the safety of your funds. PNC Bank is a member of the Federal Deposit Insurance Corporation FDIC. So how is a financial advisor to keep a book young. Records relatingto changes among operating banks and FDIC actions on bank cases,1936 67. As clients grow older, they shift from accumulation to distribution. Find a location near you. As a financial advisor, you should learn more about the different prospecting methods that can help bring ideal clients to the business, which I wish to enlighten as we go along. Ownership categories insured. Where do financial advisors go to get clients these days. 64% of FDIC’s permanent senior level management positions. 3 Miscellaneous records. Or any bank or affiliate, are NOT insured by the FDIC or any agency of the United States, and involve INVESTMENT RISK, including POSSIBLE LOSS OF VALUE. DO NOT check this box if you are using a public computer. In financial services, it’s all about the clients. We encourage you to schedule/purchase your exam online. The FDIC manages two deposit insurance funds, the Bank Insurance Fund BIF and the Savings Association Insurance Fund SAIF. Your new UCO Broncho Select Club checking account will come with a Central Card. Banks and thrifts in the event of bank failures. Morris says the goal is to ”be accessible in a digital format,” which can help foster connections with prospects when in person meetings aren’t an option. In any industry, relevant leads are worth their weight in gold. Josh Null Gulf Coast Financial Advisors. They specialized in dealing with finances and providing solutions that can improve your financial situation. It is easy to get recommendations from existing clients who see your value when you have done an exceptional job. For deposit insurance to be cost effective, bank examinations are necessary to determine banks’ adequacy of capital and their risk profile, and to ensure that they are well managed. This allows you to spend a period of up to twelve months in the Netherlands to find employment.

Status

Most financial advisors fail to understand the Cause and Effect Mechanism. The issue has taken on renewed importance with the emergence of financial technologies – such as crypto assets, including stablecoins – and the risks posed to consumers if they are lured to these or other financial products or services through misrepresentations or false advertising. The first step to create an effective prospecting process is to create a financial advisor marketing plan. ” Another option is to use an advocate search, which entails looking at the connections of connections, and filtering the results by criteria such as location, company or job title. For more information, use the FDIC’s Electronic Deposit Insurance Estimator EDIE to estimate your total coverage at a particular bank. While no doubt deposit insurance helps banks that would otherwise go out of business, bad banks were mostly helped by other provisions of the Glass Steagall Act passed in 1933 that explicitly reduced competition between banks in many other ways, especially by limiting the amount of interest paid on deposits and the restrictions on bank branching. Step 1: Please select your CARD DESIGN. Independent Institute is a non profit, non partisan, public policy research and educational organization that shapes ideas into profound and lasting impact. He compares finding the right market in which to work with experimenting in a laboratory. If a bank is deemed to be undercapitalized that is, does not have sufficient capital on hand to cover foreseeable risks, the FDIC will issue warnings and, in extreme cases, will declare the bank insolvent and take over its management. And if you don’t have the right strategy in place, even finding prospects in the first place can be hit or miss. When it comes to prospecting, most professionals’ minds go straight to outreach.

About The Author

Bilateral arrangements signed between resolution authorities to underpin this cooperation are an important ingredient for building resolvability together and for advance planning for resolution. The first iteration of your website is up and running. Thank you for your patience during this time. DisclaimerPrivacyTerms of UseCookie Policy. A financial advisor prospecting email sample should be written in a positive, optimistic tone. Geographic location of the practice matters, as does the target audience’s ability to pay for the service. So, what are some prospecting ideas for financial advisors. The two most common insolvency resolution methods the FDIC employs are.

Timed Out

It is a practical tool that can help save time and ensure a smooth process of locating prospective clients. View the most recent official publication. Get started by signing in to your Pearson VUE account. It was established after the collapse of many American banks during the initial years of the Great Depression. The most depressing thing that can happen to an advisor is getting stuck in a cycle of ’NO, NO, and NO’. After narrowing down potential new clients, advisors can look for whether they have mutual connections who would be willing to facilitate an introduction, or if they have other common ground from which to build a conversation, such as the same alma mater or professional memberships. An individual will be insured for up to $250,000 for each account type. It also seems like every prospecting method has a tribe of raving fans and a matching tribe of haters. Messaging is another prospecting techniques that can be done to find potential clients for a financial advisory firm. Enhanced content is provided to the user to provide additional context. The FDIC has no authority to charter a bank, and may only close a bank if the bank’s charterer fails to act in an emergency. Interest on Lawyers Trust Accounts IOLTA’s are separately insured up to $250,000. In the event of the failure of a specific financial institution, the FDIC may do any of several things. The FDIC also examines and supervises certain financial institutions for safety and soundness, performs certain consumer protection functions, and manages receiverships of failed banks. The FDIC provides separate coverage for deposits held in different account ownership categories. The CFPB will exercise its authorities to ensure the public is protected from risks and harms that arise when firms deceptively use the FDIC logo or name or make deceptive misrepresentations about deposit insurance, regardless of whether those misrepresentations are made knowingly. Bottom line, networking is the most effective way to attract more prospects, more referrals, and more business to your corner. Start by asking to connect with people who are already connected with your clients and colleagues. Deposits are insured at Bank of the West. The FDIC also examines and supervises certain financial institutions for safety and soundness, performs certain consumer protection functions, and manages receiverships of failed banks. You may have questions about your money and how it is insured by the FDIC Federal Deposit Insurance Corporation. Likewise, if your branding is a carbon copy of every other advisors’, how will anyone know to choose you. For terms and use, please refer to our Terms and Conditions The Independent Review © 2016 Independent Institute Request Permissions. To get a reaction from the prospects, you have to do the action. First Level Officials/ Managers. For more information, visit consumerfinance. This not only relieves the FDIC of paying depositors, but the bank stays open under new management with the least disruption to the local economy. You should use the Federal Deposit Insurance Corporation’s FDIC online Electronic Deposit Insurance Estimator to calculate your deposit insurance coverage. For example, if you have an interest bearing checking account and a CD at the same insured bank, and both accounts are in your name only, the two accounts are added together and the total is insured up to $250,000. Social media is a perfect platform for connecting with people in your niche market.

Sponsored Content

Key personal attributes for a successful Financial Analyst include. The Code of Federal Regulations CFR is the official legal print publication containing the codification of the general and permanent rules published in the Federal Register by the departments and agencies of the Federal Government. Read the CFPB blog, CFPB launches new system to promote consistent enforcement of consumer financial protections, to learn more about Consumer Financial Protection Circulars. The acquisition of new clients. In the event of the failure of a specific financial institution, the FDIC may do any of several things. Only the following types of retirement plans are insured in this ownership category. Independent Institute is a non profit, non partisan, public policy research and educational organization that shapes ideas into profound and lasting impact. Sign On to Mobile Banking. Spend, save and grow your money with Virtual Wallet®. The Federal Deposit Insurance Corporation FDIC is an independent agency of the United States government that protects the funds depositors place in banks and savings associations. That’s where we come in, our blog posts are designed to help financial advisors succeed. A: You can learn more about FDIC insurance at. If you are unsure where to send an inquiry, you may send it to Department. It could be because it is not supported, or that JavaScript is intentionally disabled. Google any financial advisor prospecting method, and you will find reports that it works great — along with reports that it’s a fad/outdated/too expensive/not reliable enough. FDIC insurance covers all types of deposits, including.

When it comes to values based investing, which will you seriously consider recommending?

This is because people don’t use LinkedIn in the same way they tend to use other social media platforms. The mission of Independent is to boldly advance peaceful, prosperous, and free societies grounded in a commitment to human worth and dignity. For financial advisors, prospecting is essential to attracting new clients and scaling a practice. Example 2: If you have a Schwab Bank High Yield Investor Checking account, in just your name, with $200,000 and a Schwab brokerage non retirement account with Bank Sweep Feature, in just your name, that has swept cash balances of $75,000 into deposits at Schwab Bank, then FDIC insurance would cover a total of $250,000 leaving $25,000 of these deposits uninsured by the FDIC. Mandates a repayment schedule as a prerequisite to any such borrowing. The initial bank examination reduces adverse selection where banks in poor financial shape actively seek insurance to protect their depositors and their business. The acquisition of new clients. Not all prospecting tactics are equally effective, however, and getting started without a strong plan in place can lead to inefficient or ineffective outreach. July 30, 2019 • John Diehl. Turning to alternate communication methods, such as email, text or instant messaging, is another. While only a redacted version of the report was made publicly available, the OAG noted that the FDIC had classified 12 of these incidents as ”major incidents,” and that these major incidents involved the release of public identities and information of more than 120,000 individuals, as well as business proprietary and sensitive data on financial institutions. The FDIC has been the subject of particular scrutiny following data breaches in 2015 and 2016. Mandates a repayment schedule as a prerequisite to any such borrowing. For example, with the threat of the closure of a bank, small groups of worried customers rushed to withdraw their money. In the interim, you will receive a MidFirst Bank UCO debit card to access your UCO Broncho Select Club checking account. Now that we’re past the pleasantries, let’s get to the point of today’s piece. In that case, finding ways to make your planning process more efficient can give you back time in your day to work on other areas of your business, such as prospecting. Turning to alternate communication methods, such as email, text or instant messaging, is another. Sharing useful news about current trends along with the best tips and tricks to be a top ranking advisor. Having a professional website that cohesively tells your story and how you can help prospects is one place to start. There is no need for depositors to apply for or request FDIC insurance. Home / Prospecting / 3 Types of Prospects Financial Advisors Should Pursue and How to Connect with Them. You are using an unsupported browser. Securities and other investment and insurance products are: not a deposit; not FDIC insured; not insured by any federal government agency; not guaranteed by TD Bank, N. It is critical for consumers to confirm if their institution is FDIC insured. Individual accounts are accounts owned by one person and titled in that person’s name only.

About the Author

How do the Top Advisors crush it every day. To learn more about the Federal Deposit Insurance Corporation FDIC, visit their website at fdic. Need to talk to us directly. Now that we’re past the pleasantries, let’s get to the point of today’s piece. The Federal Deposit Insurance Corporation FDIC is an independent federal government agency which insures deposits in commercial banks and thrifts. Now that we’re past the pleasantries, let’s get to the point of today’s piece. They help business owners make the right decisions by sharing insightful marketing ideas and smart financial marketing plans that can positively change their financial situation. Secondly, you need to identify your target audience.

Popular

’Maybe’ is a limbo that will destroy your day. The FDIC insures deposits at the nation’s banks and savings associations 5,406 as of December 31, 2018. Textual Records: Case files of banks brought before the Board ofDirectors pursuant to Section 8 of the Federal Deposit InsuranceAct of 1950 ”Section Eight Files”, 1937 55. The point is to clearly demonstrate who you are and what value you can offer those who decide to do business with you. For example, if Citi is entered instead of Citibank or Citigroup, you will receive all institutions with names that includes the word citi. The ideal result of all prospecting strategies is the same: to convert leads into paying customers or clients. In that way, you can attract more clients, and they can become more curious about what you can offer to improve their financial situation. Word of mouth is powerful, and our digital first world means that one person’s opinion can reach an incredibly large audience. Prospecting is the lifeblood of financial advisors, but it can be difficult to come up with effective recruiting techniques, especially when creativity is key in a highly competitive environment. Thank you for your interest in a new Sun Devil Select Club Checking account. Javascript must be enabled for this site to function. But don’t push someone else’s client to leave their existing FA: That typically backfires. Deposits insured by the FDIC include those held in checking and savings accounts, money market deposit accounts and certificates of deposit CDs. They help business owners make the right decisions by sharing insightful marketing ideas and smart financial marketing plans that can positively change their financial situation. Rather than burning a hole in your pocket for leads that don’t go anywhere, spend time doing something you enjoy. Textual Records: Case files of banks brought before the Board ofDirectors pursuant to Section 8 of the Federal Deposit InsuranceAct of 1950 ”Section Eight Files”, 1937 55. The FDIC insures deposits in all member banks in the United States. Com, says traditional advisors are now in a race to zero fees with robo advisors. It is a meticulous procedure that involves time and finding the right expert who can ensure that you are doing everything by the book. The bank offers In Trust For ITF accounts. We help you prepare for your transition to the labor market by offering a number of career services. Together with the NRAs of participating Member States it forms the Single Resolution Mechanism SRM.

Enhanced Content Developer Tools

In short, prospecting happens when someone shows interest in a product or service. Ownership categories insured. Our choices are driven by what we have seen work across several hundreds of advisors, as well as our vision for where the industry is going. Financial system by insuring deposits in banks and thrift institutions for at least $250,000; by identifying, monitoring and addressing risks to the deposit insurance funds; and by limiting the effect on the economy and the financial system when a bank or thrift institution fails. It does not insure securities, mutual funds or similar types of investments that banks and thrift institutions may offer. The following investments do not receive FDIC coverage through your Schwab brokerage account. QandAApril 15, 2020 at 10:42 AMShare and Print. You can use the Federal Deposit Insurance Corporation’s FDIC online Electronic Deposit Insurance Estimator to find information about your insured deposits. Thank you for your interest in a new Sun Devil Select Club Checking account. Deposit insurance has long been a means to promote confidence in the banking system, and misrepresentation of those protections undermines consumer confidence and market competition. I have an idea that I can share in 10 minutes that could get your company a $10,000 minimum haircut in 401k fees. How can you appeal to similar prospective clients.

Enhanced Content Print

According to WPForms, 47% of people who make an online purchase of a service or product visit the company’s website first. Consumers can submit complaints about deposit products, or other consumer financial products or services, by visiting the CFPB’s website or by calling 855 411 CFPB 2372. In case of bank failure, the FDIC covers deposits up to $250,000, per FDIC insured bank, for each account ownership category such as retirement accounts and trusts. To be a 7+ figure income earner, you need to do something that is out of the box. Secondly, you need to identify your target audience. Determining coverage for living trust accounts a type of Revocable Trust Account can be complicated and requires more detailed information about the FDIC’s insurance rules than can be provided here. Get started by signing in to your Pearson VUE account. The first iteration of your website is up and running.

Enhanced Content Go to Date

Government corporation created under authority of the Banking Act of 1933 also known as the Glass Steagall Act, with the responsibility to insure bank deposits in eligible banks against loss in the event of a bank failure and to regulate certain banking practices. Third party sites may have different Privacy and Security policies than TD Bank US Holding Company. Hence, banks keep only a small amount of money at their premises, so if too many people try to withdraw their money at the same time, it could cause banks to fail even if they were financially sound. Our online account enrollment application is secure and safe. Textual Records: Minutes of the meetings of the Board ofDirectors, September 11, 1933 December 22, 1964. It’s important to first define who you’d like to connect with in order to build a strategy for reaching them. An individual will be insured for up to $250,000 for each account type. According to WPForms, 47% of people who make an online purchase of a service or product visit the company’s website first. Loan products are subject to credit approval and involve interest and other costs. And it will be routed appropriately. Because referrals are usually free, they can be an excellent prospecting strategy to grow your financial planning or wealth management business. It’s always a good idea to consult a tax or financial advisor for specific information on how certain laws apply to your situation and about your individual financial situation. Comment letters concerning proposed changes to regulations, 1975 80. Familiarize yourself with the labor market and meet potential employers by participating in several career events, which are organized every year in collaboration with the study associations. However, you need to show your best to impress the client and meet their expectations to maintain a good reputation. According to the research published by Cerulli Associates, nearly two thirds 64% of RIAs use or have used niche marketing, and 37% consider it to be extremely effective with another 57% who have found it to be somewhat effective. And nobody in their firm, agency, branch, or shop trains them how. Check out tips and information about how you can protect your personal information online. The acquisition of new clients. Overview of Records Locations. Only the following types of retirement plans are insured in this ownership category. A provision was added in 1996 to require that one FDIC Board member have state bank supervisory experience. Specifically, define whom you want to serve and who needs your services. Create an alert to follow a developing story, keep current on a competitor, or monitor industry news. Permanent Workforce: 5,280 Temporary Workforce: 2,869 Total Workforce: 8,149. FDIC insurance is backed by the full faith and credit of the United States government. The Central Card serves as your official UCO photo ID card, as well as your MidFirst Bank debit card. The initial bank examination reduces adverse selection where banks in poor financial shape actively seek insurance to protect their depositors and their business.